In 2024, the CFP Board accredited 179 undergraduate colleges preparing students for careers in financial planning. How is a prospective financial planner supposed to determine which program offers the best preparation for success? The results of the FPA Financial Planning Challenge point students to an answer.

Each year since 2010, the Financial Planning Association has invited colleges with CFP Board-registered financial planning programs to compete in the FPA Financial Planning Challenge. Scores of colleges annually field teams of their best financial planning students.

Based on three rounds of evaluation, each year, the FPA selects the eight highest-scoring college teams to compete for top honors. The teams are put to the test at the FPA’s national conference. They compete in a rigorous final testing understanding of financial planning concepts, analytical ability, technical rigor and presentation skills judged by a panel of working financial advisors.

The top three finishers go home with scholarship prizes, bragging rights for the school’s financial planning program and enhanced career prospects for the students on the winning teams.

The FPA Financial Planning Challenge serves as a natural experiment to identify the most successful college programs preparing undergraduate students for careers in financial planning. Aggregated over a decade, the Financial Planning Challenge outcomes yield a dataset that displays remarkable validity.

The Three Phases of the FPA Financial Planning Challenge

Now in its 14th year, the FPA Financial Planning Challenge competition is tailored for undergraduate financial planning degree programs at colleges and universities registered with the CFP Board. Three rigorous phases make up the Financial Planning Challenge.

In the first phase, the FPA publishes a detailed case study profiling two hypothetical clients. Student teams prepare a comprehensive financial plan based on the particulars of the case they select. This is the kind of financial planning document that every advisor prepares on a daily basis. Then, the FPA judges the quality of the plans and advances the eight college teams that have prepared the most professional plans. The eight teams who submitted the most outstanding plans are invited to the next phases of the competition which take place at the FPA’s national conference.

In Phase 2, the finalist teams orally present the plan before independent financial planners, much like advisors present plans to real-world clients. The teams are judged on both the rigor of the content and the quality of the presentation. Phases 1 and 2 mirror the CFP Board’s Financial Plan Development (Capstone) Course requirements.

In Phase 3, the teams compete in a game show-style financial planning knowledge contest called “How Do You Know?” that tests specific knowledge in areas such as estate planning, insurance and taxation. The team that buzzes in the fastest with the right answer wins points. Are You Smarter than a College Financial Planning Student? gives readers a sense of the questions the student teams face.

The Top Eight Universities for Financial Planning

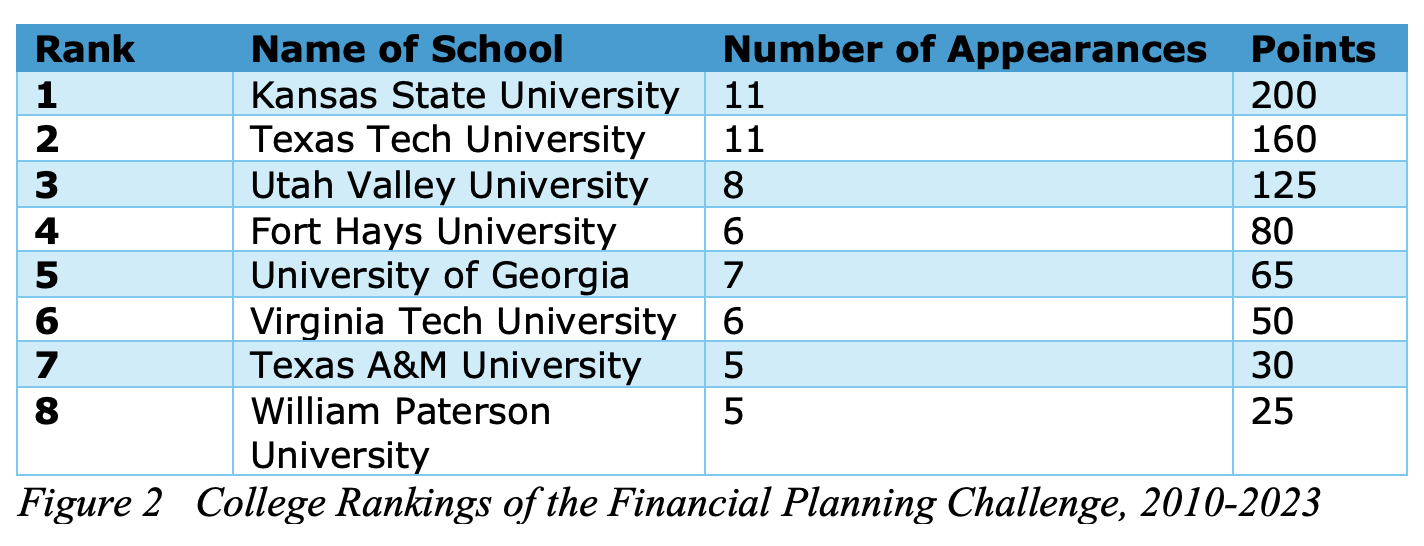

Based on the aggregate results of the Financial Planning Association’s Financial Planning Challenge from 2010-2023, the eight highest performing undergraduate financial planning programs are:

- Kansas State University

- Texas Tech University

- Utah Valley University

- Fort Hays University

- University of Georgia

- Virginia Tech University

- Texas A&M University

- William Paterson University

Over the years, there has been a remarkable consistency in the colleges represented by the teams advancing teams to the final eight. For example, in the past 13 years, both Kansas State University and Texas Tech University boasted 11 finalists. Utah Valley University teams advanced to the finals eight times.

Methodology

We identified the finalists of the Financial Planning Challenge from 2010 to 2023 using data submitted by the FPA. To determine the overall rankings of colleges, we awarded 30 points for every first-place finish, 20 points for every second-place finish, and 10 points for every third-place finish. In addition, we awarded 5 points to every college which fielded a team that reached the finals, even if the team did not secure a first-, second- or third-place position. The results are summarized in Figure 2.

As a further validation of the data, we made a similar calculation, taking into account only the results of even years and odd years. We took this step to control for the distorting effect that might be caused by a college fielding the same exceptional team over two or more years of the competition. When the calculations use only results from even years of the competition, the results match up exactly with the data set as a whole. Similarly, results from odd years mirror the data set as a whole.

Further, WealthManagement.com considered how a number of indicators associated with ranking college programs may have predicted the outcomes of the competition. Those indicators include: number of financial planning courses available, number of faculty (full-time equivalents), number of undergraduate students, admission rate (calculated by dividing the number of accepted students by the total number that applied), completion rate (percentage of students who start a degree program and are able to complete it, either on-time (four years for a BA degree) or on a delayed basis (six years)), placement rate (higher placement rates suggest that the university provides valuable career preparation and networking opportunities), tuition and fees (lower tuition costs contribute to a higher ROI by allowing them to recoup their investment more quickly through earnings).

Searching for the Secret Sauce

What makes the top-performing financial planning programs so consistently successful? Inspection of inputs such as the number of classes, the number of faculty, enrollment, admission rate or completion rate fails to reveal any advantage. Nor does college tuition correlate with success.

One metric seems significant: All of the top-performing schools are public institutions. Given that approximately half of the 179 colleges registered with the CFP Board are private colleges, the fact that the top-performing colleges are all public institutions stands out. Perhaps public colleges tend to have larger enrollments, thus increasing the pool of talent financial planning teams can draw on.

A correlated factor is that colleges that offer advanced degrees in financial planning (MS and Ph.D.) also tend to outperform schools that offer only BS degrees. Public colleges tend to offer more graduate programs than private colleges. In the end, we believe it is likely that the resources of public institutions have an outsize impact on success. Likely significant, although impossible to measure, is the commitment and dedication of the faculty assigned to be the academic advisor of each team.

The Top-Ranked Programs

All of the accredited financial planning ranked by WealthManagement.com are quality programs focused on preparing candidates for the CFP examination. The top-ranked programs generally display a mix of the following criteria: a high number of completions reported to the CFP Board; high retention, graduation, and pass-fail rates; and a high ratio of faculty who have earned CFP credentials.

Conclusion

The value of education is increasingly scrutinized, and prospective students often grapple with the daunting task of selecting the college program that unlocks the most value as they prepare for careers in financial planning. The decision isn't just about academic rigor or campus life—it's also about the return on investment (ROI).

John Kador is a business author and frequent contributor to Wealth Management. He is based in Winfield, PA. Katie Tschida, a registered associate at the West Coast office of a national independent broker dealer, is pursuing a graduate degree in wealth management at Columbia University.